Work Smarter

Not Harder

With years of experience in accounting softwore deployment and management, we can deliver the best combination of suites to empower your business.

How we can help

Build a better business

by focusing on your core competency

Accounting Software

Here at Soft-Tech Automated Solutions Limited, we like to think that every organisation has its perculiarity in terms of Accounting and inventory. That is why we take the time to understand our clients' business in order to profer the best possible combination of systems / software to help them meet there objective.

Human and capital resource management

We assist with the setup, implementation and management of various Human resource software and tools ensuring that the business keeps it focus on core values.

Accounting Packages we support

Sage Pastel Evolution ERP

Sage Business Cloud

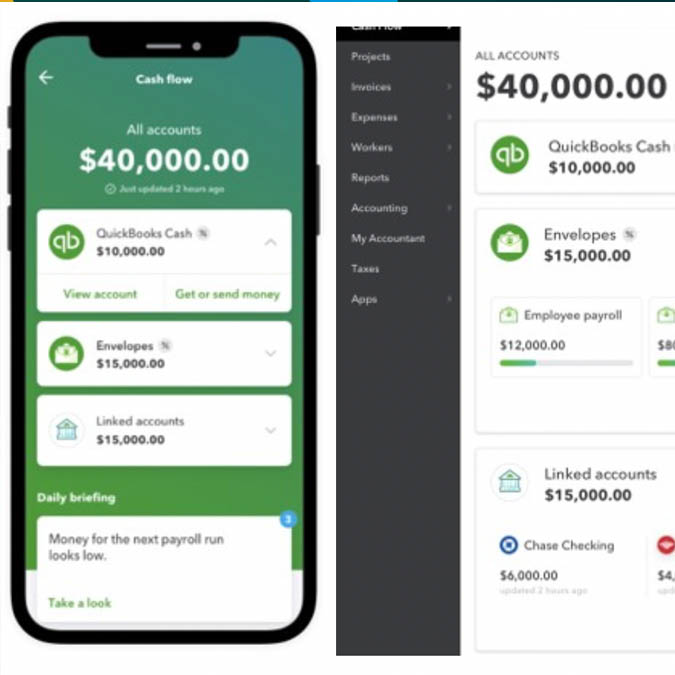

Quickbooks Accounting Suites

Sage Peachtree

.jpg)

Hybrid work setup

Depending on your need, the scope of services ensure you can perform task remotely even from your mobile phone

From Setup, implementation and maintenance, we have got you covered.

Setup automated database and server backup

With our unique solutions and resources we can ensure that in the event of a mishap, you are back online within 48 hours.

Frequently Asked Questions

Yes and Yes. Sage Pastel Evolution takes advantage of the latest database technologies, utilising MS-SQL Server or Microsoft's? SQL Express Edition. MS-SQL provides Evolution with the ability to scale and to support an unlimited number of concurrent users. The Online Web module for Sage Pastel Evolution is an extension of the BIC Module. It provides world-wide screen access for your business reports through standard web browser.

The tax thresholds at which liability for normal tax commences, are: Unemployment Insurance Fund contributions are deducted and paid over on a monthly basis. UIF provides short-term payment to workers who are unemployed, or cannot work because they are on maternity leave, ill, etc.Employers have to register with the UIF. Complete the UI-8 form and fax it to 012 337 1636. UIF will provide you with a registration number. Registration must be done within 14 days after becoming an employer. The employee contributes 1% and the company contributes 1% every month. You need to pay over the contributions by the 7th of each month. If you pay over tax to SARS, then complete the EMP101 form and pay the UIF as part of your monthly EMP201 payment to SARS. If you are not registered with SARS, then pay UIF directly. In addition to monthly payments, you need to declare your contributions to UIF. On Liquid, you can electronically submit this declaration to UIF (so, no need to complete those UI-19s manually). This declaration gives UIF all the information they need in terms of new and existing employees as well as employees leaving your employment.

Employees’ tax must be deducted from any payment made or benefit given to employees every month. The tax deducted on the payroll is seen as an advance payment of tax due by the individual at the end of the tax year.Employers have to register with SARS by completing the EMP101 form within 14 days after becoming an employer.Payment of PAYE is due every month by the 7th and must be paid as part of your EMP201 payment to SARS. Tax certificates (IT3a/IRP5) must be issued to employees at the end of February each year, or when the employee leaves the employment of an employer during the tax year. An EMP501 reconciliation must also be completed and submitted to SARS at the end of each tax year (filing season is usually April and May). Tax certificates can be printed from Liquid. Liquid also generates a file to import into e@syFile, so that you don’t have to manually capture tax certificates.